Submitted by: Donald Hank

10 Incredible Charts Highlighting the Problems Facing the Middle Class

10 Incredible Charts Highlighting the Problems Facing the Middle Class

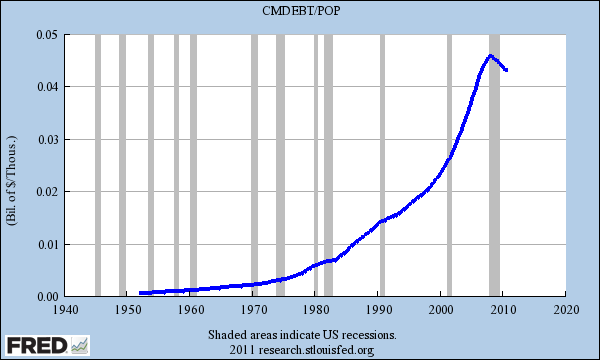

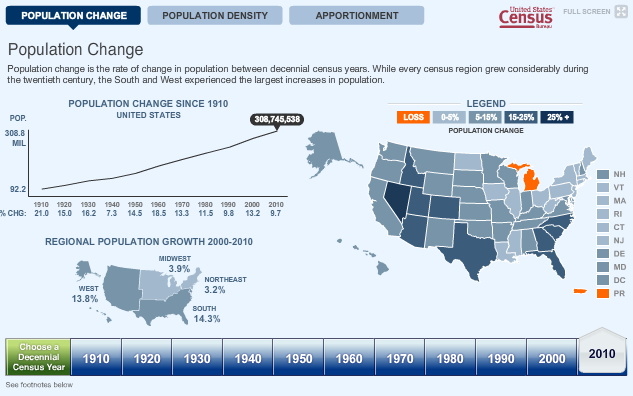

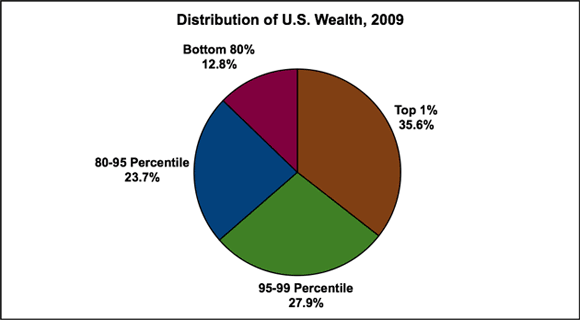

How Wall Street and the media forgot about the middle class – 10 incredible charts highlighting the problems facing the middle class. China labor costs, debt ratios, Euro-zone finances, and balance sheet disequilibrium. The mainstream press and ego driven politicians have completely forgotten about the middle class in this country, pretending as if ignoring the cacophony of discontent would simply make it go away. Both parties are simply doing the bidding of the financial upper-crust and that is why you rarely hear about household income being discussed in any television show. Yet as we are seeing with record low consumer sentiment to accompany a broken balance sheet and empty savings accounts, the public can get a dose of reality by simply examining their own life. Are things really better? What Americans should now fully realize is that the bailout schemes were nothing more than a wicked robbery and transfer of wealth from the majority to a slim connected plutocracy. Those who write and advocate for our laws, the politicians, have made sure a national thievery would go unpunished courtesy of campaign contributions. The system is completely broken and thedisappearing middle class is merely a consequence of this financial plundering. Since the tech crash, the housing crash, or the energy debacles were completely missed by the media do not expect to have any guidance coming from the paid spokesmen of Wall Street. When did Wall Street and the media decide the middle class was irrelevant? The country that debt built The collapse of the middle class can be traced back to the 1970s. For the last 40 years this contraction has largely been hidden under the rug thanks to a large helping of deep fried debt: The above chart is rather illuminating. What we have done is taken all the household debt in the United States and divided it by the population. Even accounting for this growth the trajectory is rather obvious. The middle class has felt less of the contraction because of access to debt. Of course this peaked in 2007 which is the first reversal in this trend since data started being gathered way back in the 1950s. Debt is not always a bad thing but when it is not accompanied by real income growth then problems start to boil to the top. The mainstream media is concerned with selling you goods and banks are more than happy to finance your buying even if you don’t have the money today. Banks got bored counting small shopping trips for clothes and decided to turn the biggest asset in housing into one giant speculative casino. Population growth The United States population grew at the slowest rate since the 1940s and this was largely due to World War II. From 2000 to 2010 most of the growth occurred in the West and South. Only one state in the nation, Michigan actually saw their population decline. What is fascinating is that these regions are heavily reliant on automobile travel. How will high energy costs impact growth moving into the future? Just another cost that will eat away at those stagnant paychecks. Wealth inequality In no time in our history has wealth inequality been this pronounced. We would have to go back to the days before the Great Crash of 1929 to find similar levels of inequality: The bottom 80 percent of Americans control 12 percent of all U.S. wealth. This fact should flash time and time again in the media yet this chart never hits the airwaves. After all, the media would like to keep you going like a little hamster, where every penny you earned is spent. If you don’t have the money some big bank will be willing to make you a loan and if you default, you will end up paying anyway with big giant bank bailouts. This kind of inequality crushes the fabric of what was once a vibrant middle class and has given rise to a financial plutocracy. Read the rest at My Budget 360 |

No comments:

Post a Comment