The global economy is now addicted to debt. Once debt stops expanding, the economy shrivels. But expanding debt forever is unsustainable. Welcome to the endgame.

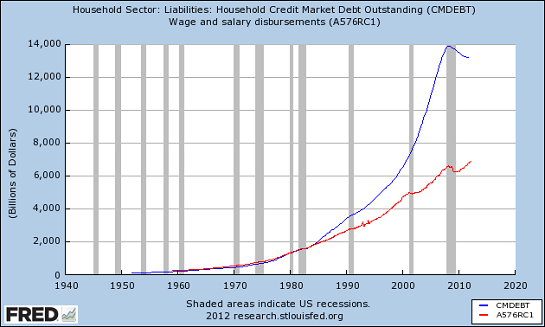

Regardless of whether you call it debt saturation or diminishing return on new debt, the notion that taking on more debt will magically enable us to “grow our way out of debt” is not supported by data. Correspondent David P. recently shared this chart of Total Credit Market Debt Owed and GDP and this explanation:

Thank you, David. Note what happened to GDP the moment debt ceased expanding in 2008: it tanked. This is the chart of debt addiction: the moment the expansion of debt is withdrawn, the economy implodes.

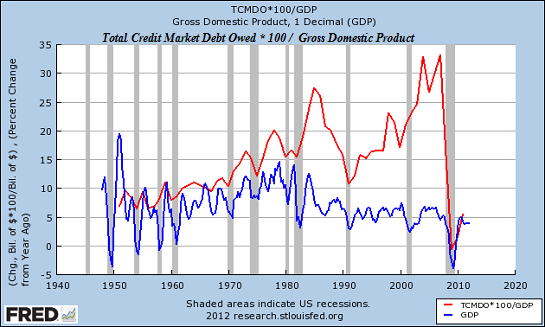

Here is a chart which shows debt has outrun income for decades:

Debt can be expanded at a rate that exceeds the rise in real income in only one way: by lowering interest rates so the same income can support a larger debt.

This is of course the reason the Federal Reserve has lowered interest rates to near-zero with the ZIRP (zero-interest rate policy).

Eventually the buyers of newly issued debt at near-zero (or even negative) yields start to fear they will never get their capital back or they will be paid back in depreciated currency, and so they demand a higher yield. Since income has already been stretched to the limit to support a towering mountain of debt, this rise in yield catapults the borrower into insolvency.

That is Greece, Spain, Italy, and eventually, the entire debt-dependent global Status Quo.

Charles Hugh Smith – Of Two Minds

|

Sunday, July 1, 2012

Why The Debt-Dependent Status Quo Is Doomed in One Chart

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment