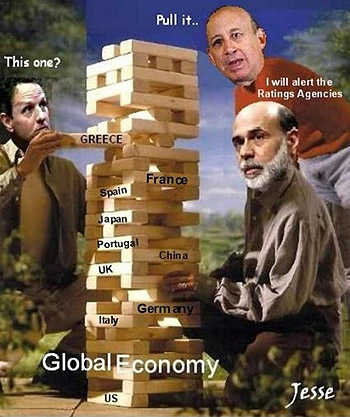

It is not just the United States that is headed for an economic collapse. The truth is that the entire world is heading for a massive economic meltdown and the people of earth need to be warned about the coming economic disaster that is going to sweep the globe. The current world financial system is based on debt, and there are alarming signs that the gigantic global debt bubble is getting ready to burst. In addition, global prices for the key resources that the major economies of the planet depend on are rising very rapidly. Despite all of our advanced technology, the truth is that human civilization simply cannot function without oil and food. But now the price of oil and the price of food are both increasing dramatically. So how is the current global economy supposed to keep functioning properly if it soon costs much more to ship products between continents? How are the billions of people that are just barely surviving today supposed to feed themselves if the price of food goes up another 30 or 40 percent? For decades, most of the major economies around the globe have been able to take for granted that massive amounts of cheap oil and massive amounts of cheap food will always be there. So what happens when that paradigm changes? At last check, the price of U.S. crude was over 104 dollars a barrel and the price of Brent crude was over 115 dollars a barrel. Many analysts fear that if the crisis in Libya escalates or if the chaos in the Middle East spreads that we could see the all-time record of 147 dollars a barrel broken by the end of the year. That would be absolutely disastrous for the global economy. But it isn’t just the chaos in the Middle East that is driving oil prices. The truth is that oil prices have been moving upwards for months. The recent revolutions in the Middle East have only accelerated the trend. Let’s just hope that the “day of rage” being called for in Saudi Arabia later this month does not turn into a full-blown revolution like we have seen in other Middle Eastern countries. The Saudis keep a pretty tight grip on their people, but at this point anything is possible. A true revolution in Saudi Arabia would send oil prices into unprecedented territory very quickly. But even without all of the trouble in the Middle East the world was already heading for an oil crunch. The global demand for oil is rising at a very vigorous pace. For example, last year Chinese demand for oil increased by almost 1 million barrels per day. That is absolutely staggering. The Chinese are now buying more new cars every year than Americans are, and so Chinese demand for oil is only going to continue to increase. Much could be done to increase the global supply of oil, but so far our politicians and the major oil company executives are sitting on their hands. They seem to like the increasing oil prices. So for now it looks like oil prices will continue to rise and this is going to result in much higher prices at the gas pump. Already, ABC News is reporting that regular unleaded gasoline is going for $5.29 a gallon at one gas station in Orlando, Florida. The U.S. economy in particular is vulnerable to rising oil prices because our entire economic system is designed around cheap gasoline. If the price of gas goes up to 5 or 6 dollars a gallon and it stays there it is going to have a catastrophic effect on the U.S. economy. Just remember what happened back in 2008. The price of oil hit an all-time high of $147 a barrel and then a few months later the entire financial system had a major meltdown. Well, as the price of oil rises it is going to create a whole lot of imbalances in the global financial system once again. This is definitely a situation that we should all be watching. But it is not just the price of oil that could cause a global economic disaster. The global price of food could potentially be even more concerning. As you read this, there are about 3 billion people around the globe that live on the equivalent of 2 dollars a day or less. Those people cannot afford for food prices to go up much. But global food prices are rising. According to the United Nations, the global price of food has risen for 8 consecutive months. Last month, the global price of food set a brand new all-time record high. Many are starting to fear that we could actually be in the early stages of a major global food crisis. The price of just about every major agricultural commodity has been absolutely soaring during the past year…. *The price of corn has doubled over the last six months. *The price of wheat has more than doubled over the past year. *The price of soybeans is up about 50% since last June. *The price of cotton has more than doubled over the past year. *The commodity price of orange juice has doubled since 2009. *The price of sugar is the highest it has been in 30 years. Unfortunately, the production of food in most countries around the world is very highly dependent on oil, so as oil goes up in price this is going to make the food crisis even worse. Hold on to your hats folks. Also, as I have written about previously, the world is facing some very serious problems when it comes to water. Due to the greed of the global elite, there is not nearly enough fresh water to go around. The following are some very disturbing facts about the global water situation…. *Worldwide demand for fresh water tripled during the last century, and is now doubling every 21 years. *According to USAID, one-third of all humans will face severe or chronic water shortages by the year 2025. *Of the 60 million people added to the world’s cities every year, the vast majority of them live in impoverished slums and shanty-towns with no sanitation facilities whatsoever. *It is estimated that 75 percent of India’s surface water is now contaminated by human and agricultural waste. *Not only that, but according to a UN study on sanitation, far more people in India have access to a mobile phone than to a toilet. *In northern China, the water table is dropping one meter per year due to overpumping. These days, one of the trendy things to do is to call water “the oil of the 21st century”, but unfortunately that is not a completely inaccurate statement. Fresh, clean water is something that we all need, but right now world supplies are getting tight. Our politicians and the global elite could be doing something about this if they really wanted to, but right now they seem perfectly fine with what is happening. On top of everything else, the sovereign debt crisis is worse than it has ever been before. All of the major global central banks have been feverishly printing money in an attempt to “paper over” this crisis, but it is not going to work. Most Americans don’t realize it, but right now the continent of Europe is a financial basket case. Greece and Ireland would have imploded already if they had not been bailed out, and now Portugal is on the verge of collapse. The interest rate on Portugal’s 10-year notes has now been above 7% for about 3 weeks, and most analysts believe that it is only a matter of time before they are forced to accept a bailout. Sadly, if the entire global economy experiences a slowdown because of rising oil prices, we could see half a dozen European nations default on their debts if they are not bailed out. For now the Germans seem fine with bailing out the weak sisters that are all around them, but that isn’t going to last forever. A day or reckoning is coming for Europe, and when it arrives the reverberations are going to be felt all across the face of the earth. The euro is on very shaky ground already, and whether or not it can survive the coming crisis is an open question. Of course there are some very serious concerns about Asia as well. The national debt of Japan is now well over 200% of GDP and nobody seems to have a solution for their problems. Up to this point, Japan has been able to borrow massive amounts of money at extremely low interest rates from their own people, but that isn’t going to last forever either. As I have written about so many times before, the biggest debt problem of all is the United States. Barack Obama is projecting that the federal budget deficit for this fiscal year will be a new all-time record 1.65 trillion dollars. It is expected that the total U.S. national debt will surpass the 15 trillion dollar mark by the end of the fiscal year. Shouldn’t we have some sort of celebration when that happens? 15 trillion dollars is quite an achievement. Most Americans cannot even conceive of a debt that large. If the federal government began right at this moment to repay the U.S. national debt at a rate of one dollar per second, it would take over 440,000 years to pay off the national debt. But the United States is not alone. The truth is that wherever you look, there is a sea of red ink covering the planet. The current global financial system is entirely based on debt. If the total amount of debt does not continually expand, the system will crash. If somehow a way was found to keep this system going perpetually (which is impossible), the size of global debt would keep on increasing infinitely. Now the World Economic Forum says that we need to grow the total amount of debt by another 100 trillion dollars over the next ten years to “support” the anticipated amount of “economic growth” around the world that they expect to see. The entire global financial system is a gigantic Ponzi scheme. It is designed to keep everyone enslaved to perpetual debt. If at some point the debt spiral gets interrupted in some significant way, we are going to witness an economic disaster that is going to make what happened in 2008 look like a Sunday picnic. The more research that one does on the current global economic situation, the more clear it becomes that we are absolutely doomed. So people of earth you had better get ready. An economic disaster is coming. The Economic Collapse |

View article...

Our economic death spiral into the Second Great Depression To avoid default Ben Bernanke chose to monetize the un-payable portion of our deficit. Each month about 100 billion dollars are created out of thin air to cover our government’s bills. This has set forth an unstoppable, self reinforcing, negative-feedback-loop whereby:

Bernanke’s Crimes Against HumanityExporting Higher Food Prices to Poor Nations:The price of grain and many other foor comodities are set in US Dollars. Creating more dollars reduces the dollars purchasing power. Creating more dollars makes investors flee securities and rush to hard assets, like grain, corn, soy, oil, cotton, coffee, sugar and so on.In Tunisia on December 17, 2010 a 26-year-old man who tried to supported his family by selling fruits and vegetables doused himself in paint thinner and set himself on fire in front of a local municipal office. Police had confiscated his produce cart, the cart he needed to earn a living in order to feed his family. With rising prices he coldn’t afford a permit. They also beat him when he objected. Local officials then refused listen to him.  His desperation highlighted the public’s frustration over living standards and increasingly higher food prices which accounted for 32.4% of their entire earnings. A month later the ruler of Tunisia was gone, its government collapsed. Now it is Libya’s turn. In Lybia 37.2% of a families budget goes to food. Many other oil producing nations have citizens who face the same income to food budget ratios. Map of many of the countries that are experiencing protests. Organic bond sales have been anemic. Money is flowing out of securities and into commodities. Bernanke’s plan to have Quantitative Easing reduce interest rates has so far been a failure because of these outflows. That was Bernanke’s first mistake. Rising commodity prices, which for the most part peg global food prices was his second misstake. Actually, if you count: Bear Stearns, the housing bubble, subprime contageon, unemployment contageon and recesion contageon they are respectively Bernanke’s 6th and 7th blunders. Add to that the fact that he is following the steps that Greenspan used to explain how Great Depression One was created and it soon becomes apparant that Ben Bernanke is, without a doubt, the worlds biggest economic imbicile and shouldn’t be allowed to balance a checkbook – let alone run the world’s (now thanks to him and Greenspan) third largest economy. Bernanke couldn’t find cause and effect in a dictionary. He is an economic moron, and a master of global disaster. The only bigger fools are our leaders who:

The gig is up, the game is almost over. When High Frequency Algorithmic Trading (insider trading) became responsible for 70% of stock trades I tossed the term “stock market” out of my vocabulary and replaced it with “rigged casino.” When Bernanke began monetizing insane amounts of money the term “Bond Vigilantes” got tossed into that same trash heap. “Bond Vigilantes” are like ants with Bernanke counterfeiting over a trillion a year. There are no more Bond Vigilantes. Ben Bernanke IS the bond market and so far he hasn’t even stepped in enough to keep yields down, but he’ll have to. It is not the smartest or the fittest that survive, it is those who notice change first. Ben Bernanke cannot stop Quantitative Easing. Stopping the monetization of debt means that the United States of America defaults on its obligations. That’s right, the government stops sending out Social Security payments, government workers stop getting checks, companies who do business with the government stop getting paid, Medicare stops – well, you get the picture. The other fallacy is that we can make cuts and balance this mess. When 23% of the deficit is debt service and 57% goes to keeping grandma eating. With those two facts in mind, we quickly realize that the deficit can’t be cut. Not without default and total restructuring. Debt is monetized when the Fed creates money with a computer and credits the Treasury Department for the Bonds it “purchased”. The treasury takes this “money” and pays the government’s bills so it can stay open. So those thinking there is no velocity may want to think that through again. With 23% unemployment and with 43 million Americans on Food Stamps and a 1.5 trillion dollar deficit the Fed can not let interest rates rise. Rising interest rates would create massive deficit pain and inflict more debt servicing nightmares. There will be no Paul Volckler’s this time. Bernanke will – en-masse – drive bond prices back up and rates back down by creating massive fake demand for bonds at auction when interest rates get too out of hand. When he does that the value of our dollar will really tank, investors will step up their continued flight to safety by purchasing commodities and commodity prices will increase even more. Higher oil prices will likely cause investors to flee the stock market, but with thin volume and 70% HFAT who knows what the rigged casino will do. They’ve made a sincere joke of the market, which for people in retirement with funds chained to the rigged house — well this is nothing but a sorrowful situation. Saudi’s king is buying time on his remaining years – he’s 87 - by handing money out. Like the fine ZeroHedge piece said: “Unfortunately for Saudi, Bahrain tried this and failed. Also, once you start down this path, there is no turning back, as people demand more and more.”China is faced with its Jasmine protest. Bernanke, the other central banks, our leaders and the leaders of the rest of the world still have time to exit this endless loop. Just about every country is broke and needs to re-value their dollar and let the people, the local and state and federal governments get out of debt. The concern I have is that other countries may exit the loop by announcing a new world reserve currency, which may be composed of one or several [other] currencies – all but ours – or with ours being a fraction of the total reserve. “If” (please read: When) the United States loses the reserve currency its printing and current debt levels will equate to an ugly and very weak exchange rate. In short, food priced in some other currency will leave us looking like Libya. You can go back through thousands of years of economic history and realize one fact: No country has ever printed their way to prosperity, all who have tried have wound up in hyperinflation, war or demise. How a guy can teach himself calculis, get into Harvard, become a professor at Princeton and NOT understand that – well it totally defies logic. The idiot was asked about the one time in our history that we had no debt. (Please don’t think we balanced the budget during the Clinton years – for you can’t debt (apply IOU’s in the Social Security Trust Fund) as income.) Andrew Jackson balanced the budget and wiped away our debt by using non debt based money. Bernanke was asked about this during a recent hearing and he scoffed at it – his merit? Because it happened before the Civil War. |

View article...

No comments:

Post a Comment