Submitted by: Donald Hank

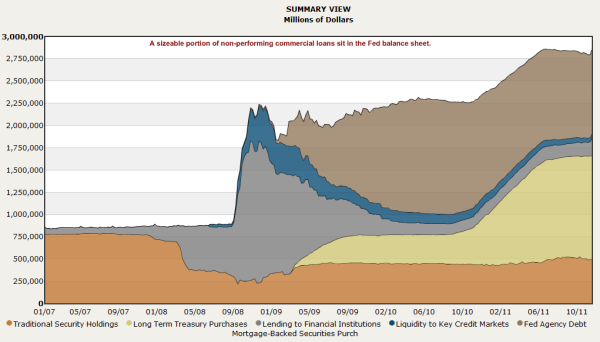

Ultimate money magician in the Federal Reserve and the art of shadow bailouts – The continuing secretive bailout of the $3.5 trillion commercial real estate market. The Federal Reserve is the ultimate magician in concealing bad bets for the flawed banking system. Few in the history of the Federal Reserve have called them out on their shadow bailouts but people are starting to wakeup no thanks to the mainstream controlled media. Think about how insane it is to have a central bank that does not even report to the people of the country it serves and is able to destroy the currency by bailing out bosom buddy bankers at the expense of the population. How is that even possible? Since this is the architecture of the system it becomes possible to create mega shadow bailouts like that occurring in the commercial real estate market (CRE). The CRE bailout is largely a sign of what is wrong with our broken financial system. Sure, with residential real estate the argument can be made that this impacts most American families. Of course even in that arena it has been a failure for the public but the CRE market is strictly a big money and big banking issue. The market imploded from being valued at $6.5 trillion a few years ago down to $3.5 trillion today. Yet why is it the responsibility for average Americans to bailout banks for bad bets on luxury hotels and failed strip malls? The continuing bailout you are not hearing about There is a false narrative flowing in the market that the bailouts are winding down and somehow we have turned a profit. All we need to do is look at the Federal Reserve balance sheet to see that this is not the case: *Update December 2011 The Fed balance sheet is at a peak nearly reaching $3 trillion in a mix of toxic loans and odd backdoor bailouts. A large part of this is bad bets in the CRE market. Think that the bailout money is only going to poor segments of our economy. How about aiding the Ritz?

Isn’t it amazing that these shadow bailout are presented as some sort of method of keeping lending going to average Americans? Instead, major CRE projects are defaulting and banks are simply ignoring the losses or are passing the bad notes over to the Fed as a sanctuary of bad bets. The public does not have this convenient access of course. Accounting trickery seems to be an area of expertise of the Fed and their fellow big bank friends. Read the rest at My Budget 360 |

No comments:

Post a Comment