|

As surpluses dwindle, borrowing money becomes the only way to prop up the Status Quo. Too bad that path inevitably leads to insolvency.

Consider the consequences of the efficient subsidizing the inefficient. As long as the surplus generated by the efficient is larger than the cost of supporting the inefficient, the system can continue.

But once the cost of subsidizing the inefficient exceeds the surplus generated by the efficient, the system is doomed to eventual insolvency.

There is one way to fill the deficit, of course: borrow money. This is the strategy being pursued by the Status Quo in developed and developing economies alike.

Identifying the efficient and inefficient sectors is not straightforward, as everyone reports they are being highly efficient. Since most of the economy is controlled by the State (a monopoly) and its favored private monopolies/cartels, the market has few opportunities to exert competition.

How much competition is there in the higher education cartel or the sickcare (a.k.a. healthcare) cartels? Very little.

As long as the inefficient are protected from competition and amply subsidized, there are no incentives to become more efficient. In effect, becoming more inefficient is rewarded.

One broad measure of efficiency for nations which do not own the global reserve currency is trade. Nations with highly efficient sectors tend to export the products of those sectors, while nations with inefficient sectors tend to import more than they export. (Owning the reserve currency creates a unique situation I have discussed elsewhere: Understanding the “Exorbitant Privilege” of the U.S. DollarNovember 19, 2012)

There are many other factors in trade, of course, such as currency valuations, trade agreements, and so on. But as a rule of thumb we can posit that efficient sectors tend to generate exports, and those revenues and profits help prop up the inefficient sectors of the home economy.

It is instructive to use Japan as an example. For two decades, Japan’s immense export sector generated vast surpluses that flowed into the home economy, supporting the inefficient monopoly/cartel sectors of government and banking, and the protected-from-global-competition sectors such as retail.

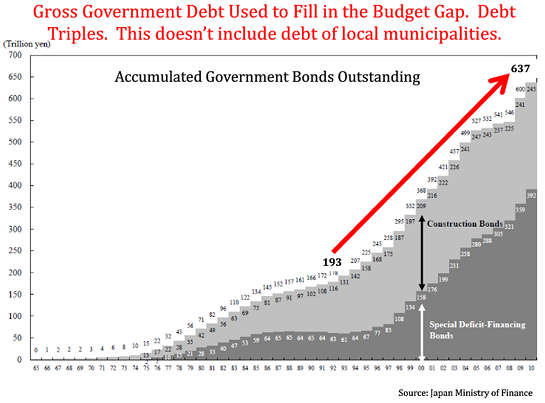

Even these surpluses were not enough to fund the inefficient sectors, so Japan borrowed gargantuan sums of money to pour into the infinitely deep rathole of its Status Quo.

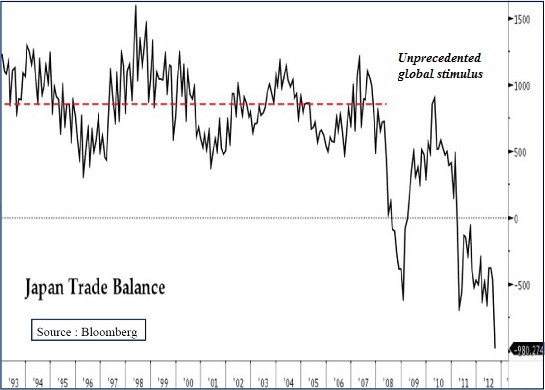

Now the surplus from trade has vanished. Consider this chart, courtesy of Zero Hedge (Meanwhile In Japan…)

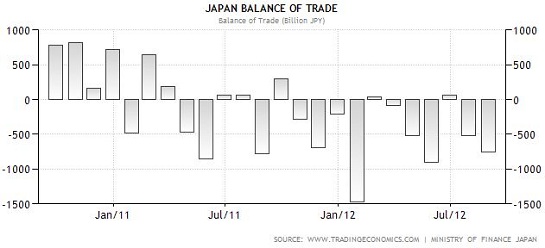

Here is another view, courtesy of Japan’s Balance of Trade:

Here is a snapshot of the staggering debt accumulated to prop up inefficient government and private monopolies and cartels:

Those of you who are familiar with Japan know that the State-private cartel partnership actively subsidized protected (i.e. inefficient) sectors as a means of distributing employment and income: a highly efficient export factory subsidized an overstaffed retail sector, for example. Where a U.S. department store might have one clerk behind a counter, a Japanese equivalent might have three or four clerks per counter.

There has been some reduction in overstaffing but it is still readily apparent when compared to U.S. staffing in retail, grounds maintenance, etc. In other words, the efficient subsidized the inefficient as a matter of redistribution policy.

Unfortunately, the deflation of the credit/stock/real estate bubble in the early 1990s wiped out trillions of yen of assets and collateral, and the Status Quo’s need to protect the banking sector from insolvency tore a giant gaping hole in this cozy subsidization/ redistribution policy.

The dead weight of an insolvent financial sector and a Central State devoted to crony-capitalist malinvestment created a drag on the entire economy, one that soaked up much of the remaining export-generated surplus.

The loss of the nation’s nuclear power has certainly added to the trade imbalance, as billions of dollars in fossil fuels are now being imported to offset the lost nuclear-generated power.

But that is not the only factor. In some areas, Japan’s export machine has lost its consumer mojo. For example, as recently as 2005, our Japanese friends carried Japanese-brand mobile phones with excellent cameras and features. Now they carry iPhones. Yes, some of the parts in the iPhone are made in Japan, but the major profits flow to Cupertino, not Tokyo.

What happens when the efficient sectors that are propping up a vast array of inefficient sectors falter? The politically expedient answer is of course to borrow more money. But that creates another kind of financial fragility.

Borrowing money only masks the fragility for a time, while adding another layer of fragility beneath the apparently prosperous surface.

We can discern this dynamic in many nations. Even export-dependent Germany is starting to experience the consequences of dependence on its most efficient sectors. As exports dry up, so do the surpluses, profits and tax revenues that distribute money from the efficient to the inefficient.

Regional surpluses and subsidies are sparking divisions in Europe that were not apparent when borrowed money subsidized everyone under the sun. Once borrowing becomes prohibitive, the structural imbalance between surplus that can be spent and what everyone expects to receive is revealed.

As surpluses dwindle, borrowing money becomes the only way to prop up the Status Quo. Too bad that path inevitably leads to insolvency.

Charles Hugh Smith – Of Two Minds

|

No comments:

Post a Comment